Table of Content

- How long does it take to get pre-approved?

- What Is a Mortgage Pre-Approval?

- What’s the difference between pre-approval and pre-qualification?

- What is pre-qualification for a personal loan?

- How long does pre-qualification take?

- Is there anything better than a mortgage pre-approval?

- What not to do after closing on a house?

Before you apply, it’s also helpful to understand the minimum requirements for getting a mortgage loan. “If you’re a serious buyer considering prequalification, it never hurts to go the extra mile and get preapproved,” says Meyer. For many people, buying a home will be the biggest investment they will make in their lives. However, home shoppers often make the mistake of waiting to reach out to a lender until they find the home they want to buy. The lender will then take that unverified information and determine how much you will likely be approved for.

Use a reliable calculator to gauge what you can truly afford month-to-month. If you were preapproved for less than you were planning to spend on a home, talk with the lender. Ask if there was a particular factor that limited the preapproval amount. Though it's rare, a mortgage can be denied after the borrower signs the closing papers. For example, in some states, the bank can fund the loan after the borrower closes. “It's not unheard of that before the funds are transferred, it could fall apart,” Rueth said.

How long does it take to get pre-approved?

The rate and loan amount you’re offered aren’t binding until you’ve completed a full loan application and submitted all your financial documents. The lender’s underwriting process will verify your eligibility, rate, and loan size. Both prequalification and preapproval are important steps in the borrowing or home buying process, but theyre not one and the same.

Most of this application process was completed during the pre-approval stage. But a few additional documents will now be needed to get a loan file through underwriting. Companies review information in your credit reports, or from other third parties, against a set of criteria. If you meet the company’s requirements, then it may send you a preapproved loan offer inviting you to apply for a loan. After analyzing your preapproval application, credit and other information, the lender will let you know if you’re preapproved for a loan. If you are, the lender will usually let you know the total amount you’re preapproved for.

What Is a Mortgage Pre-Approval?

But a preapproval is only a conditional green light that you’ll qualify for a specific loan; it doesn’t guarantee final loan approval. Final loan approval is contingent on other conditions and specifics. For example, the lender will likely want to approve the specific car or home you’re purchasing before approving the funds. Auto loans and mortgages are different, however, and will typically result in a hard inquiry on your credit that may hurt your credit scores. Fortunately, if it does, it's often a small impact that only lasts for a few months.

But prequalifying for a refinance loan will help you comparison shop without hurting your credit score. Some people use the terms prequalify and preapproval interchangeably, yet these terms are not the same. To be clear, neither a prequalification nor a preapproval guarantees a mortgage.

What’s the difference between pre-approval and pre-qualification?

So assuming you shop your loans in a short period of time, your credit will suffer little, if any, damage. The initial pre-qualification step allows for the discussions of any goals or needs regarding a mortgage. The lender will explain various mortgage options and recommend the type that might be best suited.

It's a good idea to limit your home search to houses priced at an amount you can comfortably afford. Explore the mortgage amount that best fits into your overall budget by using Bank of America's Home Affordability Calculator. The three major credit bureaus consider a prequalification a soft inquiry, which means it won’t hurt your score in any way. To prepare for a preapproval, gather your documents early and submit these to a mortgage lender in a timely manner.

What is pre-qualification for a personal loan?

The most obvious Red Flag that you are taking a personal loan from the wrong lender is the High Interest Rate. The rate of interest is the major deciding factor when choosing the lender because personal loans have the highest interest rates compared to other types of loans. Once you’ve been pre-approved or fully credit approved your Home Loan Consultant will send you a formal letter which you can share with your real estate agent. They’ll send the letter to the listing agent and seller along with your offer.

Getting prequalified for a loan is similar to getting approved for a loan. Lenders typically require your personal information and a soft credit inquiry. If you were preapproved for more than the home price budget you set for yourself, you can use the preapproval letter to shop for homes without changing your target home price. If youre happy with the amount you planned to spend, stick with your original budget. Preapproval can be extremely valuable when it comes time to make an offer on a house, especially in a competitive market where you might want to stand out among other potential buyers.

Both can help show real estate agents and sellers you’re a serious buyer. If you’re unable to prequalify for a mortgage, reach out to the lender for more details. Many lenders are happy to work with borrowers to help them improve their chances of getting prequalified for a home loan. You may need to pay down debt, save for a larger down payment, or improve your credit history before trying again.

Similarly, real estate property taxes may be lower in a mature neighborhood as compared to one which is newly built. And, association dues for a condo can vary from building to building. Current mortgage interest rates are an important part of the equation. Just because you may qualify for one of these loans doesn’t mean you should take one out.

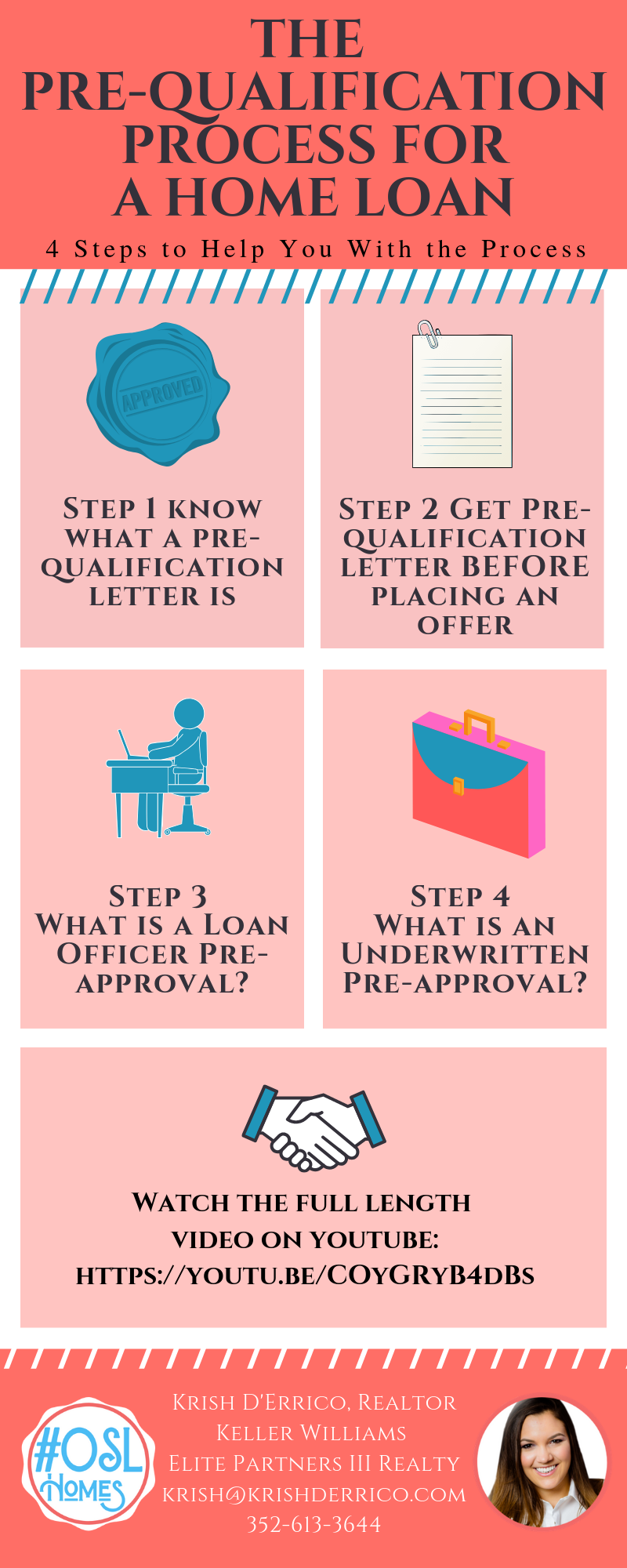

There are different types of pre-approvals or pre-qualification offers. Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. Compensation may factor into how and where products appear on our platform . But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates. The end goal of pre-qualification is to find out about you as the borrower, but a pre-approval focuses on finding out more about your finances.

No comments:

Post a Comment